Start Your Business

We make starting a business a smooth process

With Tolbert Consulting Group, we are with you from the onset and as long as you need us

Start Your Business

We make starting a business a smooth process

With Tolbert Consulting Group, we are with you from the onset and as long as you need us

We help your company take full advantage of the benefits of consulting services for business available there.

We serve as your full service business solution and we are here to walk with you every step of the way with our credit professional service groups.

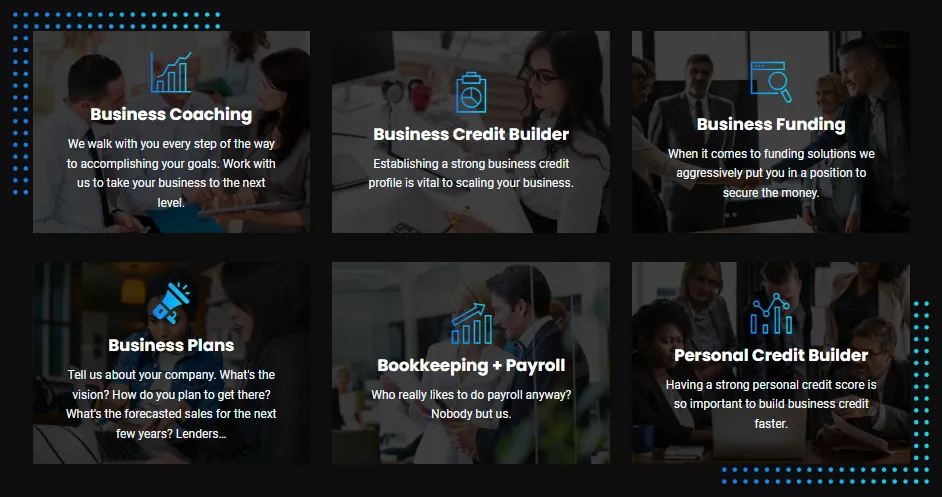

Business Coaching

Working with experienced business services and consulting is your ultimate tool to achieve massive results.

Business Management

We believe that the most efficient way to grow your business is through consistency and organization.

Is Your Business On The Path To Success?

Business owners are on 1 of 3 paths

Bridge Is Out Path

Path To Nowhere

The Success Path

Service

We're ready to share our

advice and experience.

Pre-Qualify For Business Loans

We help your business pre-qualify and build its business credit.

WANT TO HIRE US ?

Want to work with us?

Like what you see? Contact us to see what type of solutions we can deploy for your business!

We have some of the best business consultants waiting to hear from you.

Call Now Don’t Wait

TOLBERT CONSULTING GROUP PRICING

We offer the best price

to serve you.

Starter

Guaranteed Financing Available

$2,499

Virtual Business Credit Coach

Complete Business Setup

Access to 3,000+ Credit Lines

$25K Bus. Credit Guaranteed

Professional

Guaranteed Financing Available

$4,999

Everything from STARTER +

1-Year Business Credit Coaching

Personal Credit Repair

$50K Bus. Credit Guaranteed

Mastermind

Guaranteed Financing Available

$9,999

Everything from PROFESSIONAL+

Corporate Vehicle Mentorship

6-month Bookkeeping Included

$100K Bus. Credit Guaranteed

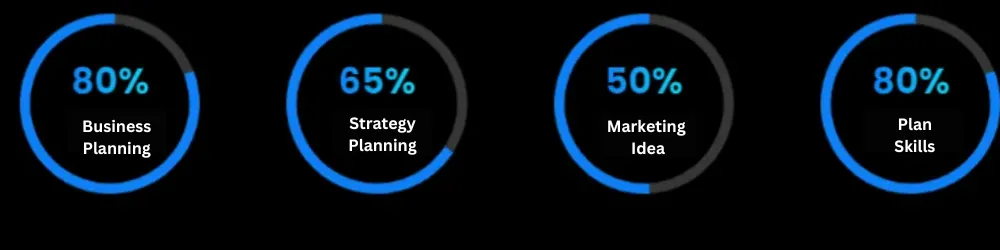

We Help Your Business Become Bankable

Becoming Bankable is having your business stand on it’s own for financing without relying on the credit of the owners. We’ve helped tens of thousands of businesses become bankable. When you run a scan you will receive a Member ID and Password to our proven business finance, business credit building, and success system. Run your pre-qual scan to get started!

TESTIMONIALS

We are very happy to

get client’s review.

Like what you see? Contact us to see what type of solutions we can deploy for your business!

Take Control of Your Credit

Be Prepared. Know your FICO Credit Score.

Get Your Personal Credit Score

LATEST NEWS

We're ready to share our

advice and experience.

Like what you see? Contact us to see what type of solutions

we can deploy for your business!

We Are All About Helping Your Business Succeed

Our Success System goes way beyond just financing and credit.

Financing & Credit

Gaining More Access

Reaching New Prospects

Quick links

Solutions

Contact Us

2024 ©️ All Rights Reserved By Tolbert Consulting Group.

Facebook

X

LinkedIn

Instagram